401k early withdrawal tax calculator

For example if you are looking. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

2022 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal Income Tax Penalties On Your Ira Or 401k Retirement Savings Plan

First all contributions and earnings to your 401 k are tax deferred.

. For tax year 2017 the tax bracket for a single filer with 75000 of taxable income is 25 percent. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If the state charges 5 percent on all income a.

However these distributions typically count as taxable income. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. Figuring Tax for 2017. The IRS typically withholds 20 of an early withdrawal to cover.

401 k Distribution Calculator. Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. You will also be required to pay regular income taxes on the.

Discover Helpful Information And Resources On Taxes From AARP. So if you withdraw the 10000 in your 401 k at age 40 you may get only. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

Our free 401 k Distribution Calculator helps you to determine your withdrawal amount and where you stand with your 401k or IRA account. Generally the amounts an individual withdraws from an IRA or retirement plan before. It provides you with two important advantages.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. As mentioned above this is in addition to the 10 penalty. So if you withdraw 10000 from your 401 k at age 40 you may get only.

401 k Early Withdrawal Calculator By Jacob DuBose CFP August 23 2021 In general you can only withdraw money from your 401 k once you have reached the age of. A 401 k can be one of your best tools for creating a secure retirement. Even if it were covered by an exception all early withdrawals from your 401 k are taxed as ordinary income.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. In this case your withdrawal is subject to the. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results Share Distributions from your QRP are taxed as ordinary income and may.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Generally anyone can make an early withdrawal from 401 k plans at any time and for any reason. Using this 401k early withdrawal calculator is easy.

The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the. The money you withdraw from your 401k is taxed at your normal taxable income rate.

As of 2021 if you are under the age of 59½ a withdrawal from a 401 k is subject to a 10 early withdrawal penalty. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax.

Know Where You Stand and How to Move Toward Your Goals With Informed Confidence.

How To File Taxes On A 401 K Early Withdrawal

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

2022 Retirement Plan Withdrawals Calculator Calculate Early Withdrawal Income Tax Penalties On Your Ira Or 401k Retirement Savings Plan

401k Calculator

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

What Is The 401 K Tax Rate For Withdrawals Smartasset

401k Early Withdrawal Calculator Q2 Creative Services

Beware Of Cashing Out A 401 K Pension Parameters

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Should You Make Early 401 K Withdrawals Due

Retirement Withdrawal Calculator For Excel

/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

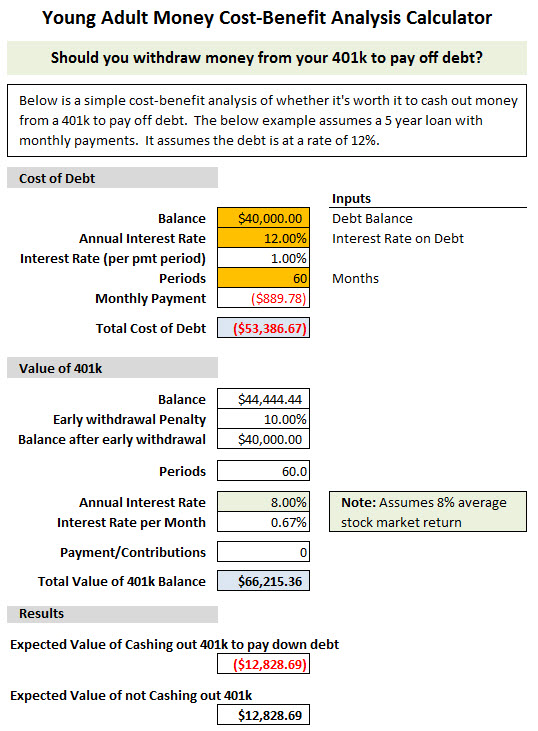

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

401k Calculator Withdrawal Collection Cheapest 56 Off Aarav Co

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Komentar

Posting Komentar